What is ESRS?

An overview of ESRS, double materiality, and how evolving EU sustainability reporting rules affect businesses globally.

Introduction:

Imagine trying to compare the nutrition labels of two products, but one lists calories in ounces, the other in joules. That’s what sustainability reporting looked like in Europe before the ESRS. Companies chose their own frameworks, disclosed what suited them, and defined “materiality” in ways that often blurred accountability. One company’s sustainability success could mean something entirely different from another’s. Without a unified standard, comparing performance was nearly impossible. Investors were left guessing, and accountability slipped through the cracks.

The European Sustainability Reporting Standards (ESRS) changed that. They brought structure to the chaos, a unified framework that makes sustainability reporting consistent, measurable, and verifiable across all EU companies. What the GHG Protocol did for emissions, the ESRS now does for the entire sustainability landscape.

Is this Only for Europe?

Technically, yes, the ESRS was designed for companies operating under the European Union’s Corporate Sustainability Reporting Directive (CSRD). But in reality, its impact stretches far beyond European borders. Any global company with significant business in the EU, or listed on an EU-regulated market, will need to comply. That means even non-European firms with European subsidiaries, supply chains, or investors are now part of this reporting web.

Think of it as a domino effect. Once major multinationals start reporting under ESRS, their suppliers and partners worldwide will need to align their data too.

Inside the ESRS Framework

The European Sustainability Reporting Standards (ESRS) might sound complex, but at their core, they’re built to create clarity. Think of them as a map that guides companies through what to report, how to report, and why it matters.

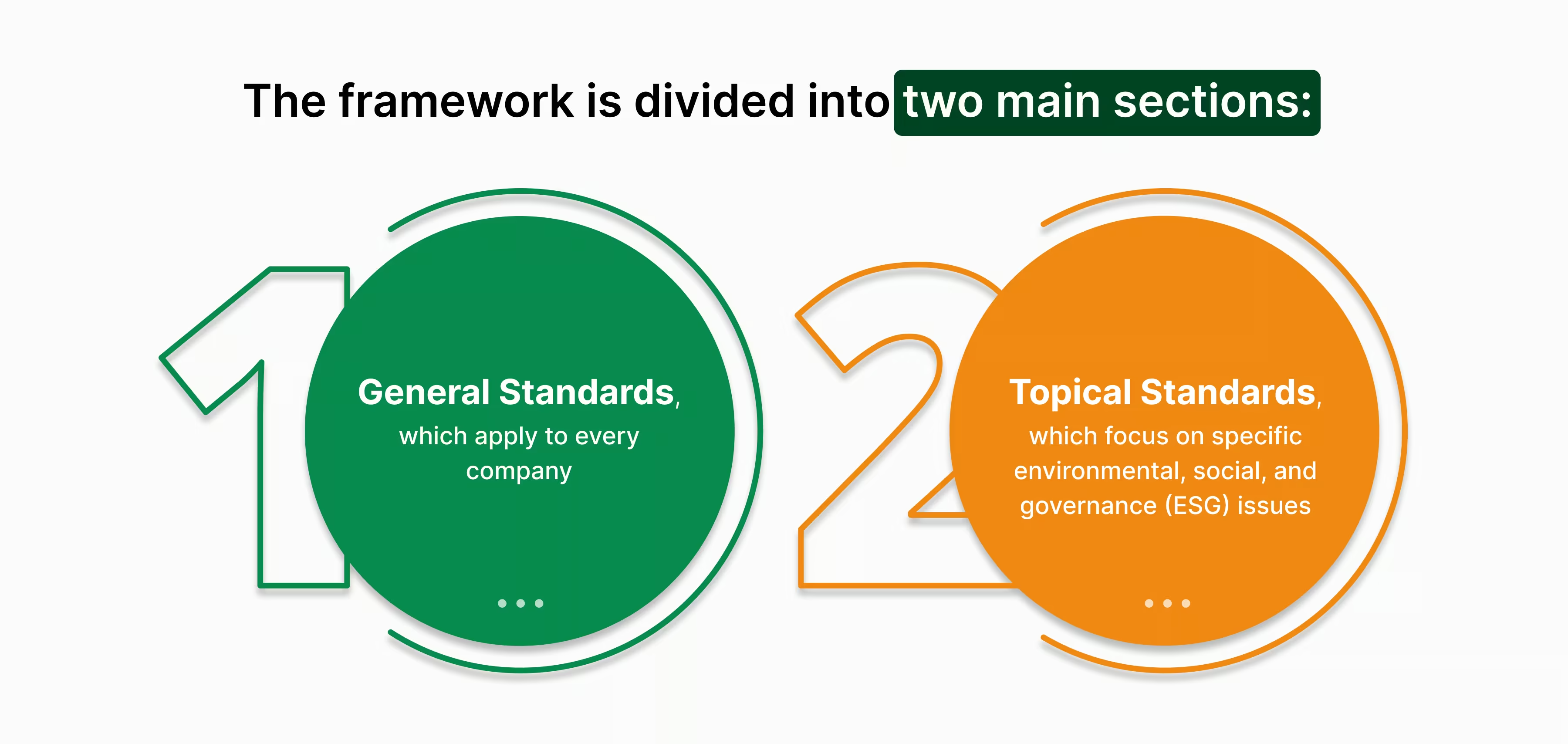

1. General Standards (ESRS 1 and ESRS 2)

These form the foundation. ESRS 1 sets out the basic principles, ensuring that companies follow the same logic, definitions, and structure in their sustainability reporting. ESRS 2 goes deeper, asking organisations to disclose their strategy, governance, and risk management related to sustainability.

2. Topical Standards

This is where things get specific. There are 10 topical standards grouped into three categories:

{{flipcards}}

Understanding Double Materiality

“We need standards that cover not just the risks to companies but also the impacts of companies on society and the environment.” – European Commission

Recent data shows that nearly 48% of companies globally say their materiality process is based on double materiality.

Before ESRS, most companies viewed sustainability through a single lens: how environmental or social issues might affect their profits. Double materiality flips that narrow view on its head. It asks two questions at once:

- First, how do climate and social risks affect your business?

- And second, how does your business affect the world around you?

This two-way lens became a cornerstone of ESRS, transforming reporting from a compliance exercise into an honest reflection of impact. The concept first appeared in the EU’s 2019 Non-Financial Reporting Directive guidelines, but ESRS turned it into a rulebook. What was once an optional perspective is now a legal obligation for companies operating under the CSRD.

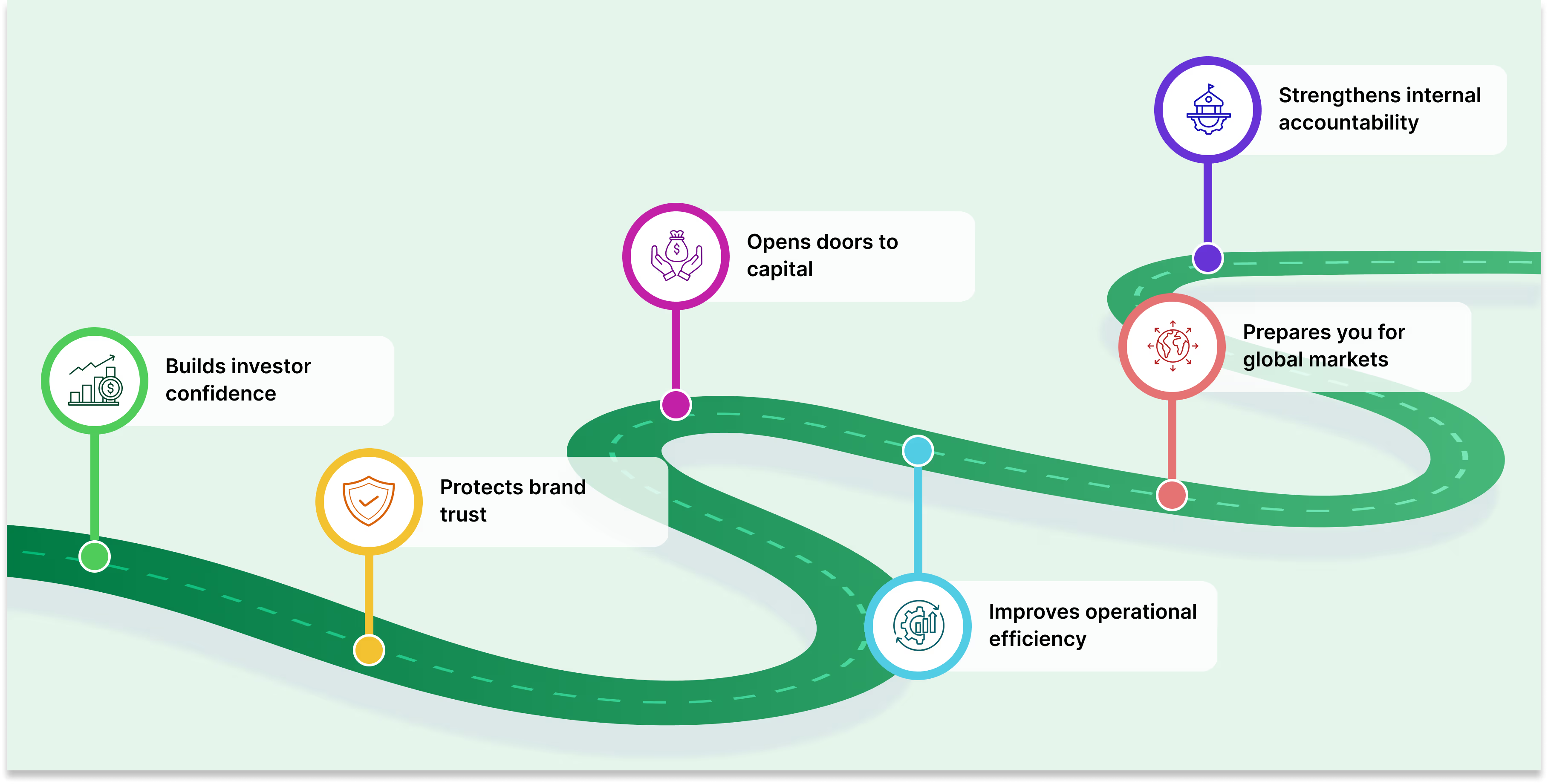

Why should You Report Under ESRS

Think of ESRS as the sustainability equivalent of international financial standards. Just as companies can’t pick and choose how to report profits, they can’t now choose how to report their environmental and social impact. The “why” is simple: transparency has become the new currency of trust. Regulators, investors, and consumers no longer take green claims at face value. They want data that is comparable and credible. ESRS provides exactly that.

- Builds investor confidence: Investors now prioritise transparent ESG data.

- Protects brand trust: In an age where greenwashing can ruin reputations overnight, ESRS pushes companies to prove every sustainability claim with verifiable data.

- Opens doors to capital: Financial institutions and lenders increasingly favour businesses with credible ESG disclosures.

- Improves operational efficiency: Gathering ESRS data often exposes inefficiencies across operations and supply chains – insights that drive cost savings and innovation.

- Prepares you for global markets: Even outside Europe, multinationals are adopting ESRS principles to meet global disclosure expectations and maintain competitiveness.

- Strengthens internal accountability: The framework requires every department, from finance to HR, to contribute to sustainability data, embedding ESG into the company’s core strategy.

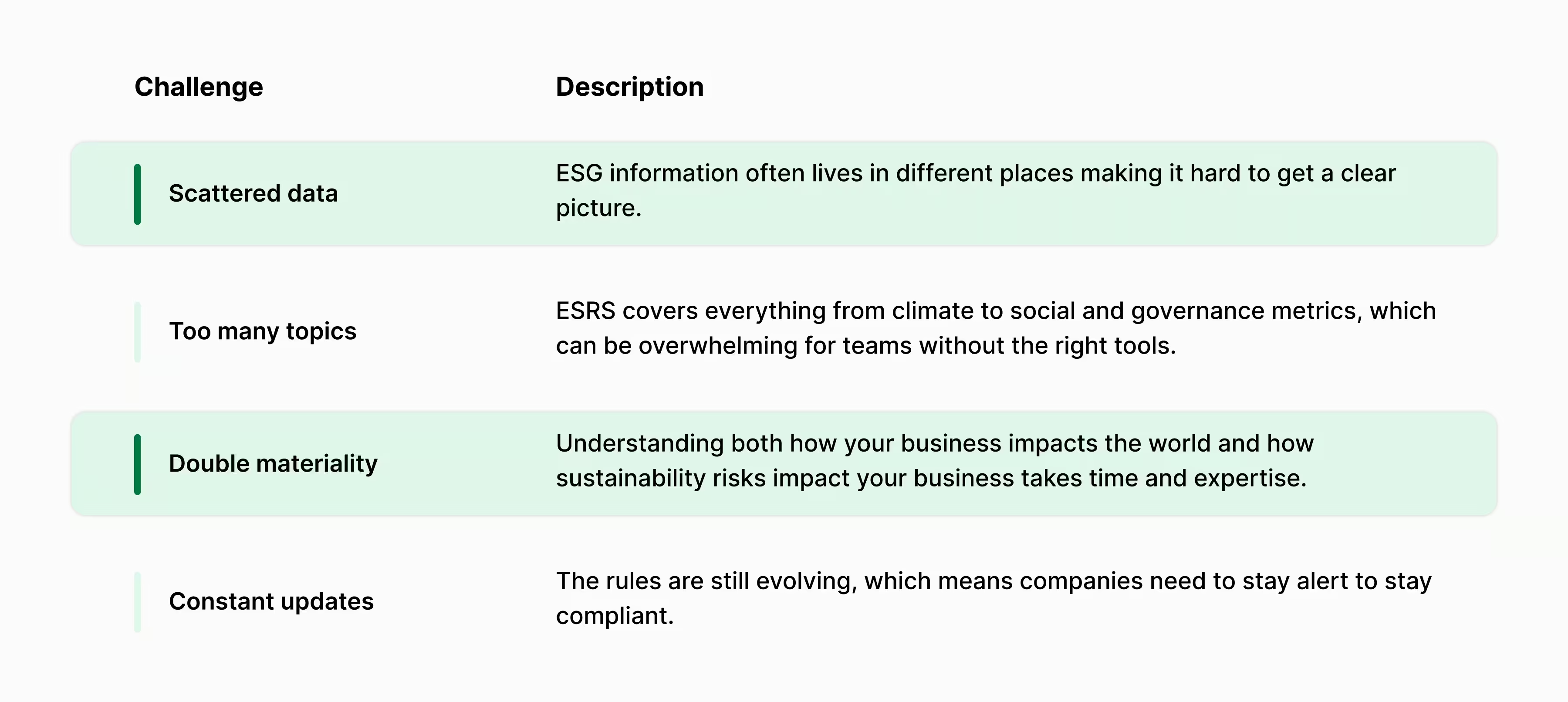

Practical Difficulties in ESRS Reporting

Getting ESRS reporting right isn’t easy. The standards are detailed, the data is complex, and many companies are still figuring out where to start. Some common challenges include:

That’s where KarbonWise comes in. The platform simplifies ESRS reporting by centralising all sustainability data, mapping it to relevant disclosure requirements, and reducing the manual effort of data collection. With KarbonWise, companies can focus less on navigating compliance complexity and more on building a transparent, future-ready sustainability strategy.

The Future of ESRS

In a few years, the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) will no longer feel like new obligations but standard business practice. One major shift is already underway: the European Financial Reporting Advisory Group (EFRAG) is proposing a reduction of roughly 66% of the mandatory datapoints companies currently face under ESRS.

What this tells us is that the landscape is evolving. Reporting will become less about ticking every box and more about quality and clarity. Soon, the rules will apply globally, aligning with standards like the International Sustainability Standards Board (ISSB) to ease the burden for multinational businesses.

For companies, this means one thing: the moment for half-measures has passed. The next era demands maturity. Data must be clean, systems must be robust, and transparency must be standard. Organisations that prepare now will gain trust, resilience and a real competitive advantage.

{{cta}}

{{accordion}}

{{sources}}

.svg)

.avif)

.svg)

.svg)