ESG Compliance Explained: Requirements, Challenges, and How Businesses Stay Compliant

A practical guide to ESG compliance, covering requirements, challenges, and how businesses stay audit-ready.

For many organisations, ESG compliance has become one of those responsibilities that feels unavoidable but difficult to pin down. Not because the concept is new, but because expectations around it have expanded faster than internal systems have adapted. What began as voluntary sustainability reporting has evolved into a dense combination of regulations, frameworks, investor scrutiny, and rising demands for data credibility.

This shift has created a familiar situation. Teams want to act responsibly and disclose accurately, yet clarity is often missing. Questions surface early and linger. Which rules apply to the business? How detailed do disclosures need to be? Who owns which data? And how can organisations be confident that what is reported externally reflects what is happening internally?

Pressure now comes from multiple directions at once. Regulators expect consistency and traceability. Investors look for signals of long-term resilience. Customers assess credibility through transparency. At the same time, leadership teams increasingly rely on ESG data to inform strategy, capital allocation, supplier decisions, and risk planning. When that data lacks structure, confidence erodes and decision-making slows.

ESG compliance is therefore no longer a reporting exercise. It has become an operational discipline.

What is ESG Compliance?

ESG compliance refers to the process of meeting environmental, social, and governance-related requirements in a way that is accurate, consistent, and defensible over time.

Recent analysis shows that nearly two-thirds of companies now report gaining meaningful business insights from sustainability reporting, signalling a shift from compliance-driven disclosure to decision-supporting ESG processes.

In practice, ESG compliance cuts across organisational boundaries. Environmental data often originates from operations, facilities, or energy management teams. Social metrics may sit with HR, procurement, or suppliers. Governance information typically involves legal, finance, and leadership functions. Each dataset serves a purpose on its own, but compliance depends on how these inputs are brought together.

What ESG compliance ultimately demands is coherence. Data needs shared definitions. Calculations need agreed methodologies. Ownership must be clear. Without this structure, disclosures risk becoming a collection of disconnected statements rather than a reliable representation of organisational performance.

Many organisations encounter difficulties at this stage. ESG data is frequently gathered for different reasons, by different teams, using different assumptions. Even when effort is high, the absence of a unifying framework can result in inconsistencies that are difficult to explain later.

When ESG compliance is treated as an afterthought, it becomes reactive and stressful. When it is treated as a structured process, it introduces accountability and reduces uncertainty across the organisation.

Why ESG Compliance Matters for Businesses

ESG compliance now influences how organisations are judged, financed, and regulated, making it a core business consideration rather than a reporting formality.

- Better strategic decision-making

ESG data increasingly informs planning, capital allocation, supplier choices, and risk management. When data is reliable and consistent, leadership teams can make decisions based on evidence rather than assumptions.

- Investor confidence and capital access

Investors use ESG disclosures to assess long-term risk and resilience. With ESG now embedded in investment decision-making, weak or inconsistent disclosures can directly affect credibility and funding outcomes.

- Customer trust and brand credibility

Customers evaluate organisations on transparency and values as much as performance. Clear, defensible ESG disclosures reduce reputational risk and support long-term trust.

- Regulatory readiness and reduced exposure

Regulators expect ESG disclosures to be accurate, traceable, and explainable. Strong compliance reduces the risk of enforcement action, penalties, and reactive remediation.

- Operational clarity and internal alignment

A structured ESG compliance approach improves coordination across teams, reduces duplication, and prevents last-minute reporting pressure caused by fragmented data.

Key ESG Regulations and Standards

Understanding ESG regulations and standards is less about memorising individual requirements and more about recognising how different frameworks and laws interact in practice. Most organisations are navigating several overlapping expectations rather than a single rulebook.

Global Reporting Initiative (GRI)

The Global Reporting Initiative is one of the most widely used ESG reporting frameworks globally. It focuses on transparency around material environmental, social, and governance impacts, requiring organisations to identify material topics and disclose standardised metrics.

A common challenge with GRI is consistency.

Materiality assessments can vary across teams and reporting cycles, and data often comes from multiple functions using different assumptions, making alignment difficult.

Sustainability Accounting Standards Board (SASB)

SASB provides industry-specific ESG standards designed to highlight financially material issues for investors. It requires organisations to align ESG disclosures closely with financial performance and sector-specific risks.

The main roadblock lies in integration. ESG and finance teams often operate separately, which can lead to misalignment between sustainability disclosures and financial reporting narratives.

Task Force on Climate-related Financial Disclosures (TCFD)

TCFD focuses on climate-related risks and opportunities, emphasising governance, strategy, risk management, and scenario analysis. Its principles increasingly underpin both regulatory and voluntary reporting expectations.

Organisations frequently struggle with the analytical depth required, particularly around scenario analysis and quantifying climate risks in financial terms.

Corporate Sustainability Reporting Directive (CSRD)

CSRD introduces mandatory, standardised ESG reporting across the European Union, significantly expanding disclosure scope and assurance requirements. It places ESG data on similar footing to financial information.

The key challenge is readiness. Many organisations lack the governance structures, controls, and audit-ready processes needed to meet CSRD expectations at scale.

Managing overlap across regulations

The real complexity arises from overlap. GRI, SASB, TCFD, CSRD, and emerging regulations draw on similar data but apply different structures and levels of assurance. Without a unified system, organisations duplicate effort and risk inconsistency. Effective ESG compliance depends on connecting these requirements through shared data and governance rather than managing them in isolation.

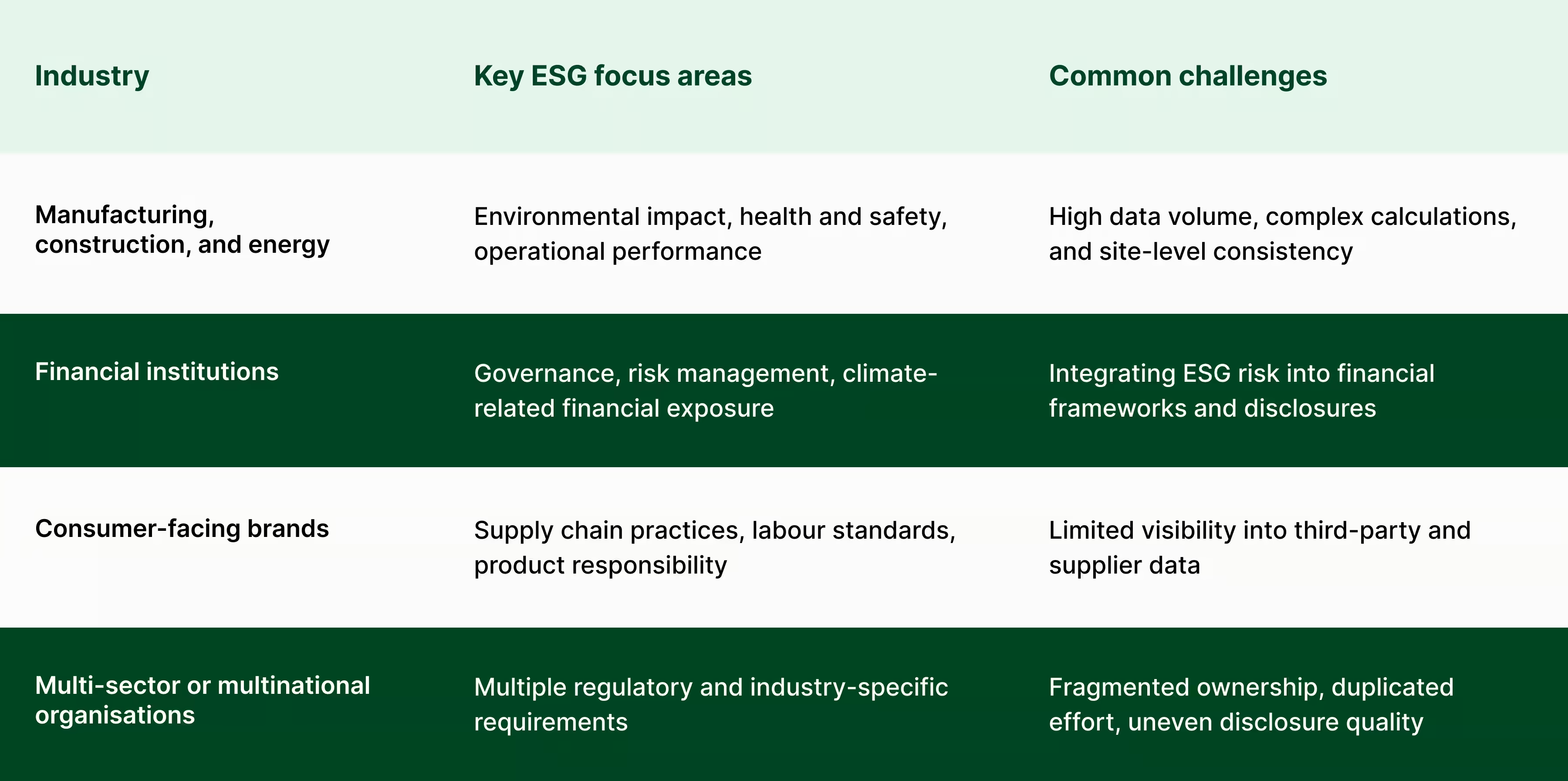

Industry-Specific ESG Obligations

How ESG Compliance Works in Practice

Step 1: ESG data identification and collection

ESG compliance begins with data that already exists across the organisation. This includes emissions, energy use, water consumption, workforce metrics, supplier information, and governance policies. The core challenge is rarely data availability, but coordination across functions and systems.

Step 2: Data consolidation and governance

ESG data is typically spread across systems, spreadsheets, emails, and external partners. Without governance, collection becomes inconsistent and difficult to scale. Definitions drift, updates are delayed, and validation becomes manual. Introducing structure at this stage is critical.

Step 3: Ownership, methodology, and process definition

Effective ESG compliance establishes clear data ownership, agreed methodologies, and documented processes. Information is collected and reviewed throughout the year, rather than assembled under pressure before reporting deadlines. This creates consistency and reduces last-minute risk.

Step 4: Risk assessment and control mechanisms

Once data is structured, organisations assess ESG-related risks, including climate exposure, supply chain vulnerabilities, and governance gaps. Controls ensure changes are tracked, assumptions are recorded, and anomalies are identified early, supporting defensibility.

Step 5: Reporting, disclosure, and audit readiness

Reporting and disclosure are the outputs of this workflow. Data is mapped to relevant standards, disclosures are prepared, and responses are managed for regulators, investors, and other stakeholders. Audit readiness is built throughout the process, supported by clear traceability from source data to final figures.

ESG Risk Management

ESG risk management increasingly delivers value by strengthening how organisations make decisions under uncertainty. As regulatory expectations rise and operating environments become less predictable, organisations that integrate ESG risk into core decision-making gain earlier visibility into emerging pressures, allowing them to act before risks escalate into disruption.

A key benefit lies in recognising that ESG risks rarely occur in isolation. Climate events can disrupt supply chains, supply chain disruption can affect workforce stability, and workforce instability can expose governance weaknesses. Organisations that understand these interconnections are better positioned to anticipate knock-on effects, prioritise responses, and avoid reactive decision-making when issues intensify.

When ESG risk is treated as a decision-support input rather than a reporting requirement, it directly improves strategic outcomes. Investment timing, supplier selection, market expansion, and capital planning benefit from a clearer understanding of how environmental, social, and governance risks intersect over time. This leads to more resilient strategies, particularly in volatile or highly regulated markets.

Embedding ESG risk thinking into everyday decision processes also reduces long-term exposure. Instead of explaining impacts after they occur, organisations can plan for multiple scenarios, prioritise mitigation earlier, and allocate resources more effectively. At this stage, ESG compliance moves beyond documentation and begins to influence outcomes, supporting preparedness, continuity, and long-term resilience.

Benefits of Strong ESG Compliance

Strong ESG compliance delivers value that extends beyond regulatory obligation. Its real impact becomes visible when compliance begins to influence how risk is prioritised, capital is allocated, and performance is evaluated across the organisation.

{{flipcards}}

Common ESG Challenges

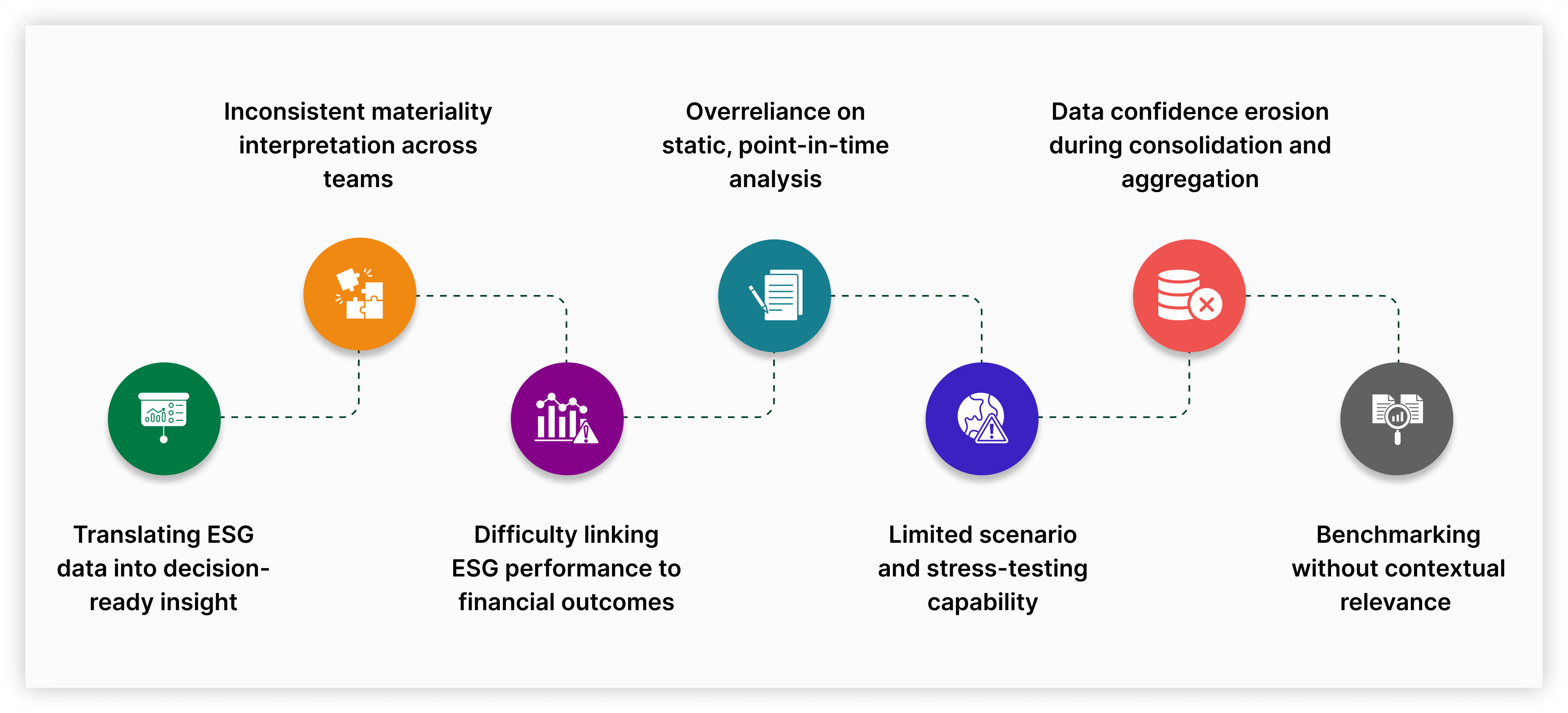

Even organisations that have invested time and resources into ESG compliance often encounter deeper analytical challenges once reporting matures. These issues go beyond basic data collection and reflect how ESG information is interpreted, stress-tested, and used in decision-making.

A. Translating ESG data into decision-ready insight

One of the most overlooked challenges in ESG compliance is not data availability, but data usability. Many organisations can produce ESG metrics, yet struggle to interpret what those numbers mean for strategy, risk, or performance. ESG data is often reviewed in isolation rather than analysed alongside financial, operational, or supply chain data. As a result, insights remain descriptive rather than actionable.

B. Inconsistent materiality interpretation across teams

Materiality assessments are central to ESG compliance, but interpretation often varies across functions. What sustainability teams consider material may differ from finance or risk perspectives. This misalignment creates analytical blind spots, where certain risks are underweighted or opportunities overlooked.

C. Difficulty linking ESG performance to financial outcomes

As ESG expectations evolve, stakeholders increasingly look for evidence of financial relevance. A common analytical gap lies in connecting ESG performance to cost, revenue, capital access, or risk exposure.

D. Overreliance on static, point-in-time analysis

Many ESG disclosures rely on annual snapshots rather than continuous analysis. This static approach masks trends, volatility, and emerging risks.

E. Limited scenario and stress-testing capability

Advanced ESG analysis increasingly requires scenario-based thinking, particularly for climate and transition risks. Without stress testing, ESG analysis remains backward-looking.

F. Data confidence erosion during consolidation and aggregation

As ESG data moves from source systems to consolidated reports, confidence often erodes. Over time, it becomes difficult to explain how final figures were derived.

G. Benchmarking without contextual relevance

Benchmarking is frequently used to assess ESG performance, but comparisons are not always meaningful. Without context, organisations risk drawing the wrong conclusions.

How KarbonWise supports ESG compliance in practice

As ESG compliance expectations increase, many organisations find that understanding requirements is only the first step. The real challenge lies in executing those requirements consistently across teams, systems, and reporting cycles.

From fragmented requirements to structured execution

As ESG compliance matures, execution becomes the defining challenge. Requirements may be understood, but coordination remains difficult.

KarbonWise supports ESG compliance by embedding structure into data collection, governance, and reporting workflows. Compliance becomes part of everyday operations rather than a periodic scramble.

Templates clarify what needs to be reported, and responsibilities are assigned clearly across teams. Automated triggers and reminders support timely updates throughout the year, reducing reliance on manual follow-ups. AI-driven validation highlights anomalies early, improving data quality before deadlines approach.

Governance, framework alignment, and audit confidence

As ESG compliance expectations rise, organisations need systems that not only collect data, but also govern it consistently, align it to recognised standards, and stand up to external scrutiny. Strong governance and framework alignment form the foundation for credible, audit-ready ESG disclosures.

- Strong governance and controlled collaboration

The platform supports both centralised and distributed organisations, enabling collaboration across teams while maintaining control through role-based access. This ensures clear accountability without limiting how functions or locations work together.

- Alignment with global frameworks and regulations

ESG data is mapped to recognised frameworks and regulatory requirements, including GRI, BRSR, CSRD, SECR, and TCFD. A single underlying data structure can be reused across disclosures, supporting consistency and reducing duplication.

- Audit confidence and regulatory readiness

With traceable, well-governed data, ESG disclosures become explainable and defensible. Organisations are better prepared for regulatory review, audit processes, and stakeholder scrutiny.

Ready to put ESG compliance on a structured, audit-ready footing? Explore how KarbonWise supports end-to-end ESG compliance and request a demo.

Conclusion

ESG compliance has become integral to how organisations operate and are evaluated. Understanding regulations is only the starting point. What matters is how those requirements are translated into consistent processes, governance structures, and decision-making.

When ESG compliance is approached systematically, it reduces risk and builds trust. When it is neglected, it creates exposure and uncertainty.

Getting ESG compliance right is not about perfection. It is about clarity, consistency, and control. With the right foundations in place, compliance supports resilience and long-term credibility rather than hindering progress.

{{cta}}

{{accordion}}

{{sources}}

.svg)

.avif)

.svg)

.svg)