Decoding SASB: Turning Sustainability into Strategy

SASB helps companies identify and report the sustainability issues that are financially material to their business. This article explains how SASB works, why investors rely on it, and how organisations can use it to align ESG reporting with long-term financial performance and emerging IFRS standards.

We often hear that embracing sustainability gives a company a competitive edge. But here’s the catch: not every ESG metric will work in your favour. Some may barely move the needle on your business, while others could have a real impact on your performance and reputation. That’s why it’s crucial to know which metrics actually play in your favour, and focus your efforts there.

So, who’s looking to get this right? If you’re a company, an investor, or anyone interested in understanding which sustainability issues truly matter to business performance, keep reading. In this blog, we’ll break down SASB and show how it helps pinpoint where real impact lies.

What is the Sustainability Accounting Standards Board (SASB)?

Not every sustainability framework asks the same question. The CSRD looks at how a company impacts the environment and society, while the GRI examines how a business affects the world around it. The SFDR focuses on the financial sector, how investment products integrate ESG risks and opportunities.

But SASB takes a different path altogether. Established in 2011 as a non-profit organisation, its focus has always been on what’s financially material: asking, which sustainability issues actually matter to your company’s performance?

Instead of covering every ESG topic, SASB zeroes in on the factors that can influence profits, risks, and long-term resilience, helping businesses focus on what truly drives impact.

In 2022, the International Sustainability Standards Board (ISSB) took over responsibility for SASB Standards, ensuring their continued evolution under the global IFRS Sustainability Disclosure Standards. While the SASB framework now lives under ISSB, its principles remain vital, helping companies identify the ESG issues that are most relevant to investors and financial performance.

Understanding the SASB Framework in Practice

Let’s walk through how a company applies SASB standards, and what makes the framework tick.

First thing: industry matters. SASB doesn’t use a one-size-fits-all list of issues. Instead, it has 77 industry-specific standards, each tailored to the risks, opportunities, and sustainability realities of that sector. To figure out which standard applies, companies use the Sustainable Industry Classification System (SICS®) – SASB’s own way to group industries based on shared ESG risk profiles, rather than just revenue type.

Once you’ve identified the right industry standard, the framework gives you three key building blocks: disclosure topics, metrics, and technical protocols.

{{flipcards}}

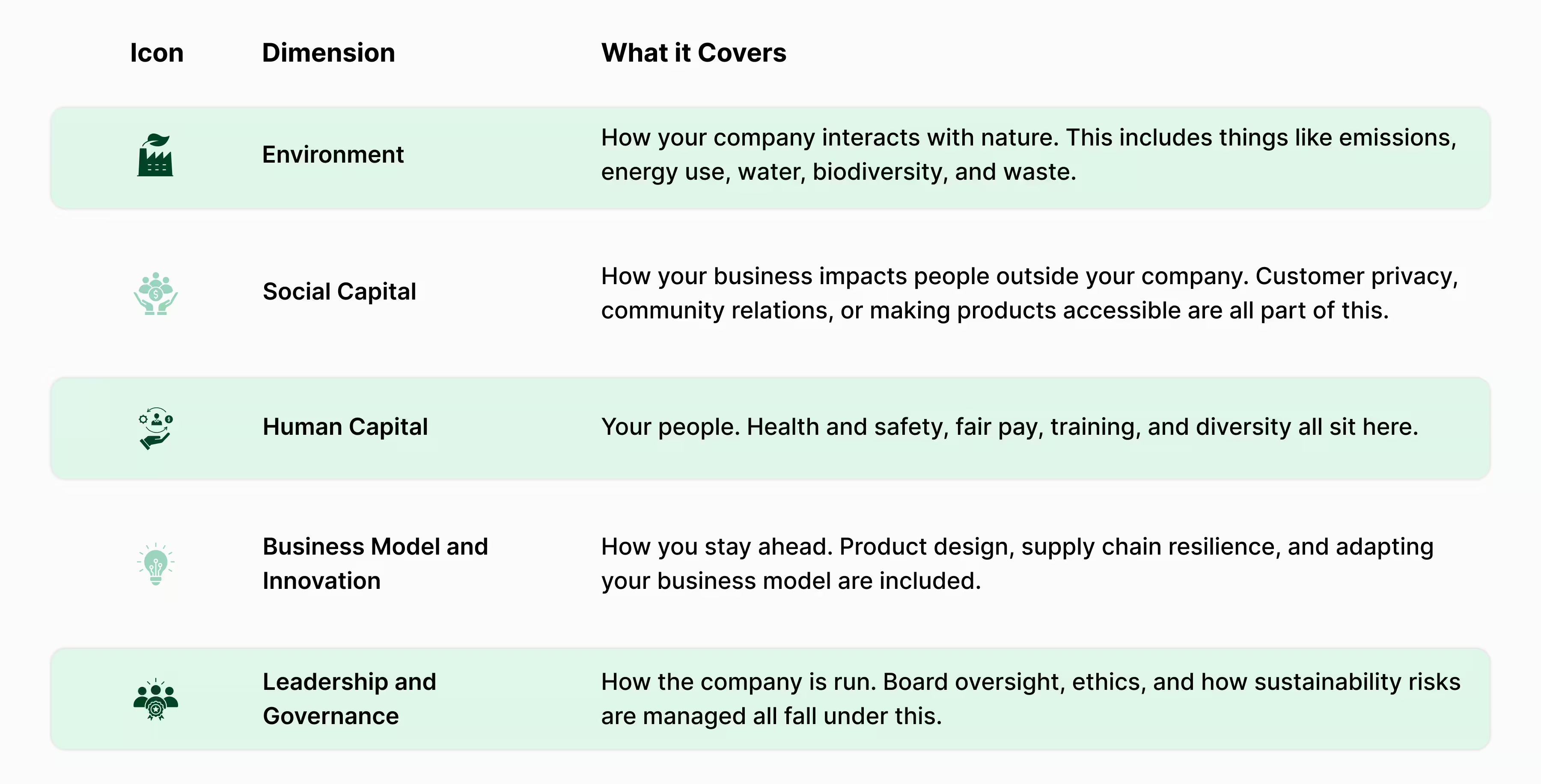

SASB Dimensions: What they Really Mean

SASB breaks sustainability down into five key dimensions, making it easier for companies to figure out what really matters. Think of it like a lens that zooms in on the issues that could actually affect the business.

In short, these five dimensions help companies cut through the noise and focus on ESG issues that actually matter.

Does Everyone Follow SASB?

While SASB has become one of the most respected frameworks for sustainability reporting, not every company uses it. Some choose GRI, CSRD, or other local and global frameworks instead, depending on what their investors or regulators care about.

That said, SASB is especially popular with investors and companies that want to show how ESG issues affect financial performance. Because it’s industry-specific and financially material, it’s seen as very useful for decision-making, even if it’s not legally required.

Why Following SASB Makes Sense

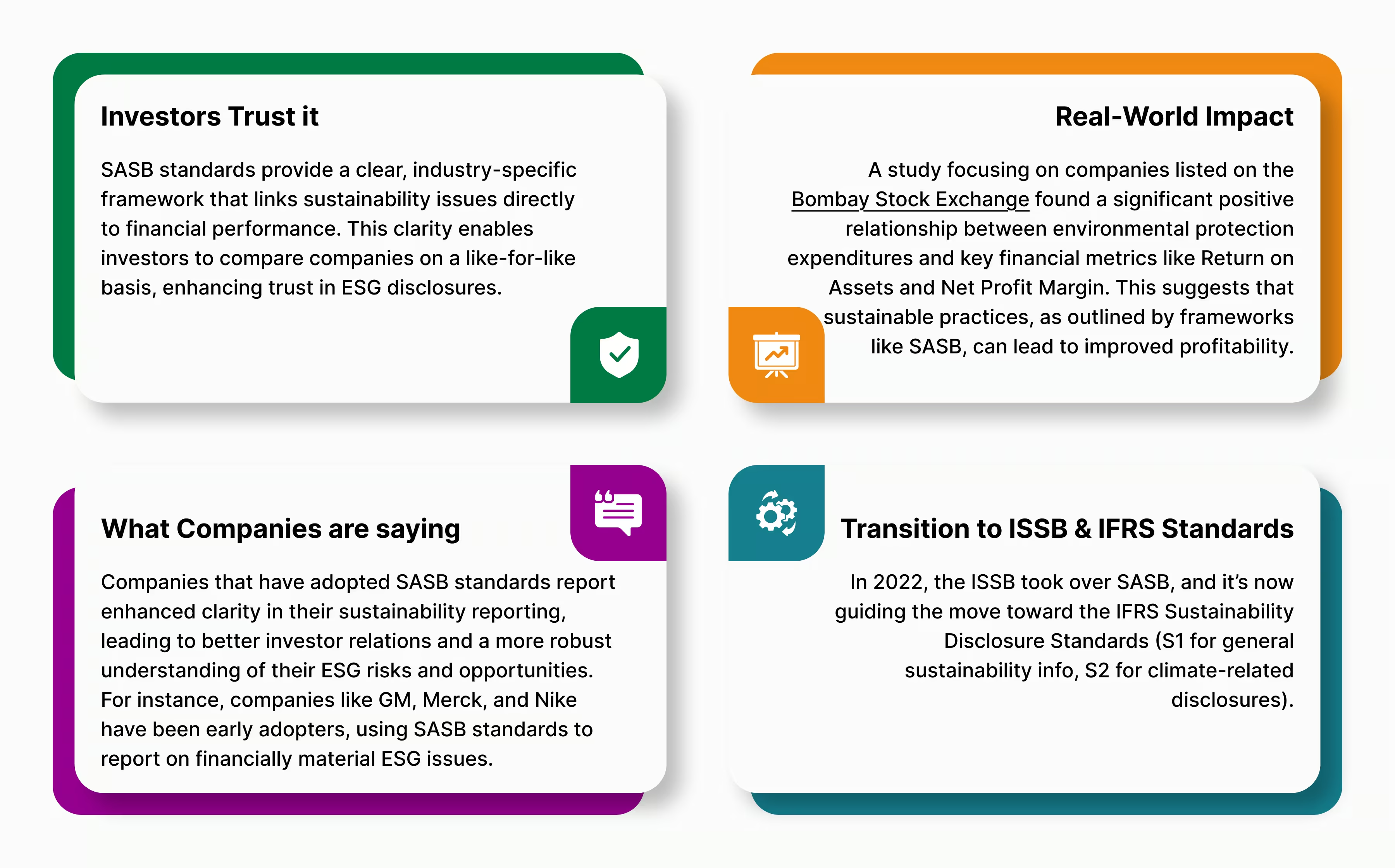

1. Investors Trust it

SASB standards provide a clear, industry-specific framework that links sustainability issues directly to financial performance. This clarity enables investors to compare companies on a like-for-like basis, enhancing trust in ESG disclosures.

2. Real-World Impact

A study focusing on companies listed on the Bombay Stock Exchange found a significant positive relationship between environmental protection expenditures and key financial metrics like Return on Assets and Net Profit Margin. This suggests that sustainable practices, as outlined by frameworks like SASB, can lead to improved profitability.

3. What Companies are Saying

Companies that have adopted SASB standards report enhanced clarity in their sustainability reporting, leading to better investor relations and a more robust understanding of their ESG risks and opportunities. For instance, companies like GM, Merck, and Nike have been early adopters, using SASB standards to report on financially material ESG issues.

4. Transition to ISSB & IFRS Standards

In 2022, the ISSB took over SASB, and it’s now guiding the move toward the IFRS Sustainability Disclosure Standards (S1 for general sustainability info, S2 for climate-related disclosures).

Here’s why it matters: companies that adopt SASB today are already reporting in a way that fits these new global standards. That means when IFRS reporting becomes mandatory, these companies won’t have to scramble, they’re ahead of the curve.

Challenges Companies Face with SASB Reporting

- Fragmented ESG data collection

Collecting reliable ESG data across multiple sites and teams is often challenging. Information is gathered in different formats, at varying intervals, and with inconsistent accuracy, increasing the risk of delays and errors.

- Complexity of industry-specific standards

With 77 industry standards, organisations may struggle to identify which SASB metrics are relevant to them and how to apply them consistently year after year.

- Technical reporting requirements

Even once the correct metrics are identified, calculating them accurately can be difficult. Emissions categories, normalised activity metrics, and specialised calculations often require expertise that internal teams may not possess.

- Transition to ISSB alignment

The integration of SASB into the ISSB framework adds further pressure to future-proof disclosures. Companies must now consider alignment with IFRS S1 and S2 and ensure current reporting can stand up to future global requirements.

- Rising expectations for assurance

Although external assurance is not mandatory, investor expectations for transparency and credibility continue to rise. Many organisations feel compelled to seek assurance before their reporting systems are fully mature.

- Pressure on reporting teams

Taken together, these challenges can slow reporting cycles, create inconsistencies, and leave teams uncertain about whether their disclosures genuinely meet stakeholder and investor expectations.

Turning Complexity into Clarity with KarbonWise

SASB reporting gives companies a clear, investor-focused way to measure the ESG issues that truly matter. As we’ve seen, the process isn’t always easy. From collecting accurate data, to navigating industry-specific metrics, to aligning with future IFRS standards, the hurdles can quickly pile up.

That’s where KarbonWise comes in. By streamlining data collection, automating metric calculations, and ensuring compliance with both SASB and upcoming IFRS standards, KarbonWise turns a complex task into a smooth process. Companies can now focus on strategic decision-making, spotting risks, and creating real impact without getting lost in spreadsheets or technical protocols.

In short, with SASB as the framework and KarbonWise as your guide, sustainability reporting stops being a headache and starts being a business advantage!

{{cta}}

{{accordion}}

{{sources}}

.svg)

.avif)

.svg)

.svg)